Financial Planning for Small Businesses is the backbone of sustainable growth for today’s entrepreneurs. With a clear, written plan, owners can avoid missed opportunities, overspending, and cash crunches by aligning day-to-day decisions with long-term goals. This descriptive guide blends practical steps with actionable tactics, including budgeting for small business, cash flow management for small businesses, and financial forecasting for small businesses. By translating your business plan into measurable financial goals and implementing a simple budgeting framework, you set the stage for steady, intentional growth. Whether validating a new product, stabilizing cash flow, or planning for expansion, robust financial planning helps you anticipate risks, make informed decisions, and allocate scarce resources more effectively.

Beyond the headline, a solid financial strategy for small enterprises charts revenue paths, cost controls, and capital needs across planning horizons. Think of it as budget planning for growth, liquidity management, and forecasting that aligns with your business model and market realities. Using related terms such as small business budgeting, cash flow planning, and financial health monitoring helps you cover the topic from multiple semantic angles. In practice, this approach creates a flexible financial roadmap that guides decisions about financing, investments, and workforce planning as conditions change.

Mastering Small Business Financial Planning: A Practical Roadmap

Financial Planning for Small Businesses serves as the backbone of sustainable growth. A practical roadmap helps owners translate ambition into measurable steps, ensuring that every decision—from pricing to hiring—aligns with long-term aims. By embracing the broader concept of small business financial planning, you can move beyond reactive spending and toward proactive resource allocation that fuels steady progress.

This Descriptive approach starts with clarifying what success looks like in financial terms. Define concrete targets, such as monthly recurring revenue, profit margins, and cash reserves, then translate these targets into timelines. With a clear goal structure, you can begin gathering historical data, building budgeting frameworks, and establishing forecasting practices that make it easier to prioritize actions and protect against cash shortfalls.

Budgeting for Small Business: Turning Goals into Action

Budgeting for small business is the practical engine that turns strategic goals into daily decisions. Create monthly or quarterly budgets that cover all major categories—cost of goods sold, direct labor, marketing, software, rent, utilities, and other overhead. Incorporate both fixed and variable costs, and build multiple scenarios (best case, expected case, worst case) to understand how shifts in revenue or costs affect cash flow and profitability.

Encourage department heads or project owners to own their budgets, which enhances accountability and makes anomalies easier to spot. This Descriptive discipline links every expense to a plan, ensuring that resource allocation supports both short-term needs and long-term goals while aligning with the overall financial planning steps for small businesses.

Financial Planning for Small Businesses: Aligning Cash Flow and Forecasting

Integrating cash flow management for small businesses with financial forecasting for small businesses creates a dynamic decision-making framework. Develop a cash flow model that projects inflows and outflows on a weekly or monthly basis, paying close attention to receivables, supplier terms, and timing gaps between revenue and cash receipt.

Combine this with realistic forecasting that reflects growth assumptions, pricing, and market conditions. Use scenario analysis to explore optimistic, moderate, and downturn futures, which helps pinpoint break-even points, required working capital, and the timing of investments. Regularly compare actual results to forecasts and adjust plans to stay aligned with the target financial trajectory.

Cash Flow Management for Small Businesses: Keeping Liquidity Robust

Cash flow management for small businesses is about maintaining liquidity that supports operations and growth. Build controls such as prompt invoicing, incentives for early payments, clear credit policies, and favorable vendor terms. A disciplined approach to cash inflows and outflows helps prevent surprises and preserves the ability to fund essential activities.

Establish a cash reserve that can cover 1–3 months of operating expenses, providing a cushion during slow periods or unexpected shocks. This Descriptive resilience strengthens your financial planning by ensuring that day-to-day decisions don’t jeopardize long-term objectives or the ability to seize opportunities when they arise.

Financial Forecasting for Small Businesses: From Projections to Strategic Decisions

Forecasting elevates budgeting from a static plan to a dynamic roadmap. Develop forecasts linked to your goals and grounded in realistic growth assumptions. Use scenarios to test how different conditions—demand shifts, price changes, or cost fluctuations—affect profitability and liquidity, guiding strategic choices about pricing, hiring, and capital investments.

Regularly track performance against forecasts, adjusting assumptions as new data comes in. This Descriptive practice helps identify break-even timing, required working capital, and critical milestones for financing, capex, or product launches. By turning forecasts into actionable insights, you create a financial planning loop that informs day-to-day decisions and long-range strategy.

Tax, Reserves, and Financing: Completing the Financial Planning Cycle

Tax planning should be integrated into the financial planning cycle, not treated as an afterthought. Track eligible deductions and credits, and coordinate with quarterly payments to maintain healthy cash flow. This step also reinforces the broader discipline of financial planning steps for small businesses by embedding tax considerations into budgeting and forecasting.

Reserves and financing decisions finalize the cycle. Decide how much to earmark for reserves and explore financing options such as bank loans, lines of credit, or equipment funding, ensuring that the cost of capital is reflected in forecasts. This Descriptive focus on financing options helps you evaluate trade-offs and ensure that long-term growth remains financially feasible, even in uncertain times.

Frequently Asked Questions

What is Financial Planning for Small Businesses and why is it essential for growth?

Financial Planning for Small Businesses is a structured approach to set measurable goals, build budgets, forecast cash flow, and prepare for risk. It helps translate your business plan into concrete targets, align daily actions with long‑term growth, and reduce cash shortfalls. A solid plan intentionally combines goal setting, data gathering, budgeting for small business, cash flow management for small businesses, and forecasting to guide decision‑making.

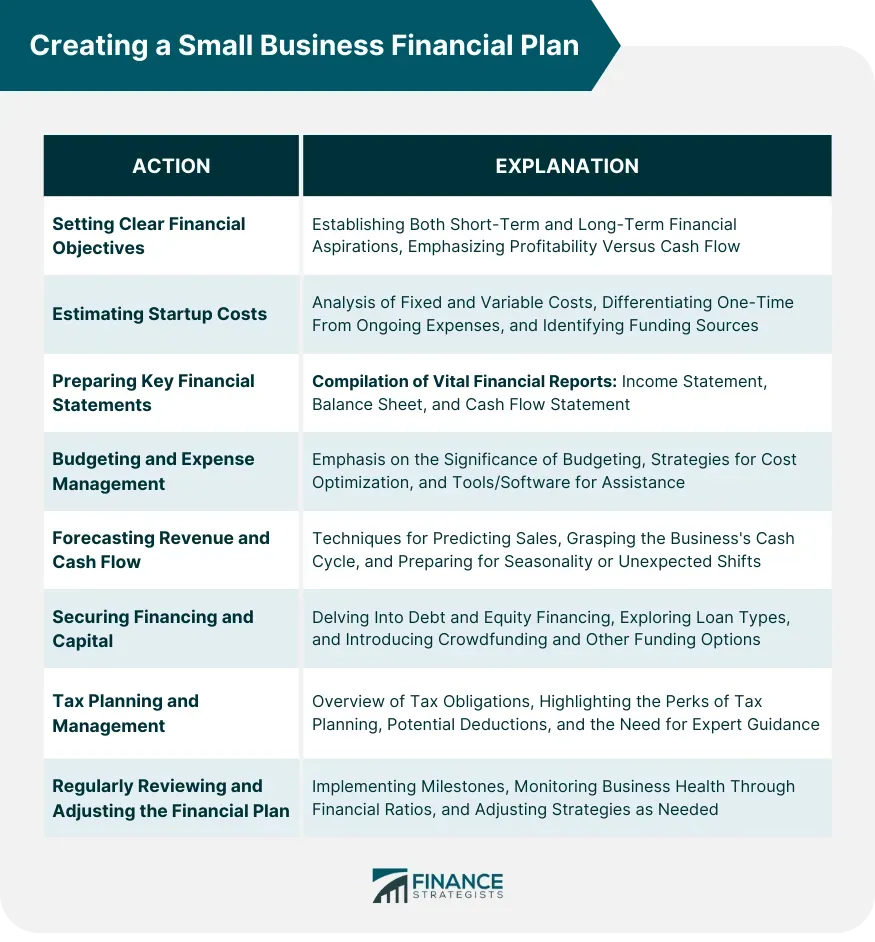

What are the essential financial planning steps for small businesses?

The essential financial planning steps for small businesses include defining clear financial goals, gathering historical data and current financials, building a budgeting framework, mastering cash flow management for small businesses, developing financial forecasting for small businesses, planning for taxes, building reserves, evaluating financing options, and establishing tools with a regular planning cadence to monitor results.

How does budgeting for small business fit into Financial Planning for Small Businesses?

Budgeting for small business is the practical engine of Financial Planning for Small Businesses. It turns goals into actionable plans by allocating resources across categories like COGS, labor, marketing, and overhead, and by building scenarios to anticipate changes in revenue or expenses. This step ensures accountability and helps guide ongoing adjustments.

How can cash flow management for small businesses be integrated into financial planning for small businesses?

Cash flow management for small businesses is integrated by building a cash flow model that projects inflows and outflows regularly, focusing on receivables, supplier terms, and timing gaps. Implement controls such as prompt invoicing, early payment incentives, clear credit policies, and negotiated terms, and maintain a reserve to cover operating expenses during slow periods.

Why is financial forecasting for small businesses crucial, and how does it inform planning?

Financial forecasting for small businesses turns budgeting into a dynamic roadmap by projecting revenue, costs, and profitability under different scenarios. It helps identify break‑even points, required working capital, and timing for investments or hiring changes, while enabling regular comparison of actual results to forecasts for timely adjustments.

How should tax planning and financing options be included in Financial Planning for Small Businesses?

Tax planning should be integrated into Financial Planning for Small Businesses to optimize deductions, credits, and quarterly payments, improving cash flow and reducing surprises at tax time. Financing options—such as bank loans, lines of credit, or equipment financing—should be evaluated within forecasts, with the cost of capital included to understand how financing affects profitability and cash flow.

| Topic | Key Points / Focus | Why It Matters |

|---|---|---|

| Introduction | Financial Planning for Small Businesses anchors sustainable growth; it reduces overspending and cash risk by providing a written plan. | Sets the foundation for budgeting, forecasting, and disciplined decision-making. |

| Step 1: Define clear financial goals | Translate the business plan into measurable goals; set timelines; include leading and lagging indicators. | Drives budgeting priorities and provides targets to track progress. |

| Step 2: Gather historical data and current financials | Collect financial statements from 12–24 months, balance sheet, cash on hand, debts, and receivables/payables; note trends and seasonality. | Establish a reliable baseline for realistic budgeting and forecasting. |

| Step 3: Build a budgeting framework | Create monthly/quarterly budgets across COGS, labor, marketing, software, rent, utilities, insurance, and overhead; include variable and fixed costs; build scenarios. | Turns goals into action and improves accountability and resource allocation. |

| Step 4: Master cash flow management | Develop a cash flow model (weekly/monthly); monitor receivables, supplier terms, and timing gaps; implement controls like prompt invoicing and early-payment incentives. | Protects liquidity and reduces the risk of cash shortfalls. |

| Step 5: Financial forecasting & scenario planning | Create forecasts aligned to goals; develop optimistic, expected, and adverse scenarios; identify break-even points and working capital needs; compare actuals to forecasts. | Supports proactive decisions on financing, capex, and hiring. |

| Step 6: Tax planning and compliance | Integrate tax considerations; track deductions/credits and quarterly payments; estimate liabilities; consult a tax advisor when needed. | Improves cash flow and avoids surprises at tax time. |

| Step 7: Build reserves & financing options | Establish a reserve and funding method; evaluate financing options (loans, lines of credit, equipment financing, investor capital); reflect cost of capital in forecasts. | Adds resilience and clarity on growth funding and risk management. |

| Step 8: Tools, templates, and processes | Use budgeting templates, cash flow sheets, and forecasting models; adopt regular planning cadences; document processes and data storage. | Keeps planning consistent and scalable across the team. |

| Step 9: Monitor, learn, and iterate | Schedule regular reviews; analyze variances; refine assumptions; adapt budgeting and forecasts as needed. | Establishes a living framework that evolves with the business. |

Summary

Table provided above summarizes the key steps for Financial Planning for Small Businesses.