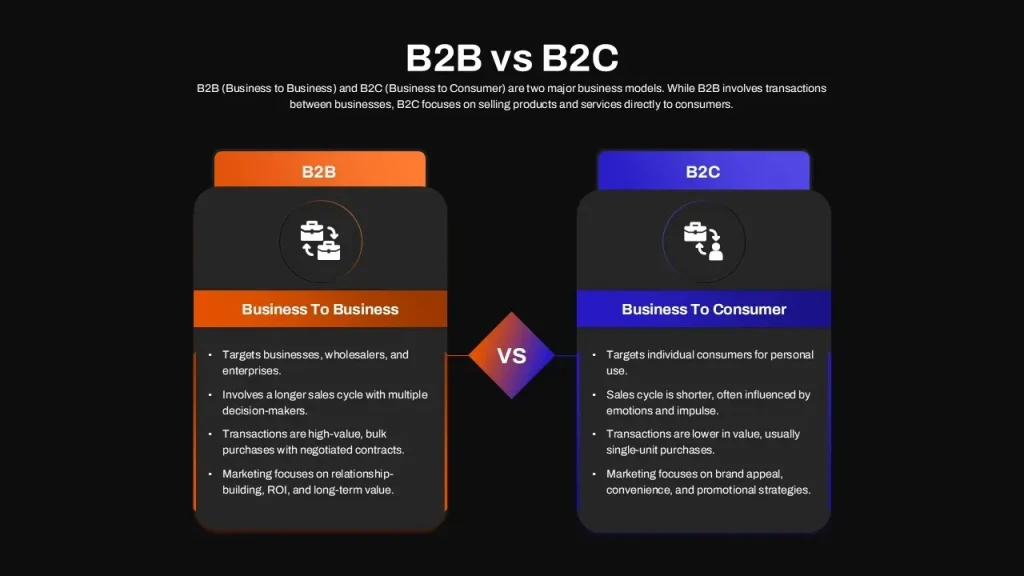

The B2B vs B2C business model shapes who buys, how deals close, and the kind of rigorous value you must demonstrate to win commitments from organizations, especially in complex enterprise settings. In practice, B2B marketing strategies require messaging that resonates with multiple stakeholders, demonstrates ROI, and builds credible relationships that survive procurement and risk assessments, across industries and buying centers. By contrast, B2C dynamics reward speed, emotion, and convenience, driving shorter cycles, higher transaction velocity, and simpler pricing that aligns with consumer wallets. Designing a go-to-market plan around the chosen model helps you optimize lead generation, qualification, and handoffs between marketing and sales across complex or fast-moving buying journeys, and post-sale support to ensure adoption. Ultimately, the goal is a scalable growth engine that aligns product strategy, pricing, packaging, and customer success with the needs of buyers, whether they purchase on behalf of a firm or for personal use, across regions and channels.

From an LSI perspective, the enterprise-facing approach aligns with corporate purchasing channels, where many stakeholders evaluate fit and total cost of ownership. The consumer-facing path mirrors direct-to-consumer dynamics, prioritizing speed, usability, and persuasive pricing at the point of sale. By using related concepts like account-based engagement, procurement considerations, and buyer psychology, you can design messaging that resonates across both ecosystems while keeping the product strategy consistent. This approach helps teams maintain focus on customer outcomes rather than channel labels, ensuring clarity in roles, content, and measurement.

B2B vs B2C business model: Key differences that shape go-to-market

Understanding the differences between B2B and B2C starts with recognizing who buys, why they buy, and how decisions are made. In a B2B environment, purchases occur within organizations, involve multiple stakeholders, and hinge on long-term value, risk mitigation, and integration with existing systems. The differences between B2B and B2C are pronounced here: deal sizes tend to be larger, approval processes slower, and buying committees add layers of evaluation thatSales and marketing must navigate.

These structural realities drive every go-to-market decision. When you map this to B2B marketing strategies and B2C customer acquisition, you’ll see a need for different cadences, channels, and success metrics. This awareness helps you tailor pricing, packaging, lead generation, and customer success to match the realities of each model, ensuring you optimize long-term profitability and sustainable growth.

Understanding the customer journey: B2B buying cycle vs B2C quick conversions

The B2B customer journey is a marathon. Prospective buyers move through awareness, evaluation, and procurement, often with a formal vendor risk review and internal ROI calculations. Marketing in this context emphasizes thought leadership, credible proof, and relationship-building to keep stakeholders engaged over time.

In contrast, the B2C journey is typically shorter and more impulsive, driven by brand resonance, price incentives, and seamless experiences. Designing a funnel for B2C requires fast touchpoints, high-velocity conversions, and easy checkout, while still capturing sufficient data for ongoing optimization and personalization.

Pricing and packaging for growth: from value-based B2B to simple B2C pricing

Pricing models for B2B and B2C are among the most visible differentiators. B2B pricing tends to be tiered, value-based, and contract-driven, with longer payment terms and larger total contract values that reflect the complexity of deployments and services.

B2C pricing favors simplicity, immediacy, and affordability, often supported by promotions and bundles. Packaging decisions—whether feature-rich enterprise options or consumer-friendly single-copy offers—should align with buyer risk tolerance and perceived value, helping to boost conversion rates and customer satisfaction.

Marketing strategies that work: B2B marketing strategies vs B2C customer acquisition

B2B marketing strategies focus on building authority and shaping the buying consensus inside organizations. Tactics include account-based marketing (ABM), demand generation, case studies, and precise measurement of qualified leads and pipeline velocity. The emphasis is on longer nurture cycles, measurable ROI, and strong sales alignment.

B2C customer acquisition centers on speed, broad reach, and emotional resonance. Branding, promotions, loyalty programs, and personalized experiences drive rapid scale and repeat engagement. Although the tactics differ, both paths benefit from coherent value propositions, tested messaging, and disciplined data-driven optimization.

Go-to-market alignment: sales and marketing collaboration for a coherent funnel

A unified go-to-market requires tight alignment between marketing and sales. In a B2B context, this often means integrated demand generation with clear qualification criteria, account-based targeting, and transparent pipeline metrics that track velocity from lead to opportunity.

In B2C models, the focus shifts to rapid acquisition and retention, but alignment remains critical. Coordinated branding, personalization at scale, and loyalty-building initiatives ensure a smooth customer journey from first touch to repeat purchases, supported by cross-functional governance and reliable attribution.

Practical steps to decide and execute: ICPs, pilots, and hybrid go-to-market

Practical decision-making starts with defining your ideal customer profile (ICP) and buyer personas for each potential model. Map the journeys, highlight touchpoints where marketing and sales can influence decisions, and build a pricing and packaging plan that aligns with perceived value and risk tolerance.

Content and channels should be tailored to the chosen model, from long-form thought leadership for B2B to short-form, high-velocity content for B2C. Run pilots in controlled segments to test messaging, channels, and pricing before scaling, and establish cross-functional governance to keep marketing, sales, product, and customer success aligned, reducing the risk of misaligned incentives.

Frequently Asked Questions

What are the main differences between B2B vs B2C business models in terms of decision-makers, deal size, and sales cycles?

In short, B2B vs B2C business models differ in who buys, why they buy, and how purchases happen. B2B deals involve organizations, multiple stakeholders, larger deal sizes, and longer sales cycles; B2C targets individual consumers with faster purchases driven by value, convenience, and emotion. Understanding these differences helps tailor targeting, messaging, pricing, and customer success plans.

How can B2B marketing strategies and B2C customer acquisition influence your choice between a B2B vs B2C business model?

Your go-to-market choices hinge on the signal that fits your product: B2B marketing strategies typically emphasize account-based approaches, thought leadership, and demand generation, while B2C customer acquisition relies on broad reach, promotions, and rapid onboarding. The decision between a B2B vs B2C business model should align with buyer behavior, channel economics, and deal velocity.

What pricing models for B2B and B2C should you consider when deciding on a B2B vs B2C business model?

B2B pricing models are often tiered, value-based, and contract-driven with longer terms, while B2C pricing favors simplicity, transparent MSRP, and promotional pricing. Packaging should match buyer risk and value, for example enterprise feature bundles for B2B versus consumer offers for B2C.

How does lead generation differ in B2B vs B2C within the B2B vs B2C business model context?

Lead generation in B2B focuses on targeted accounts, longer nurture streams, and qualified pipeline, whereas B2C lead generation leverages high-volume channels, rapid conversion, and retargeting to move quick wins.

When is a hybrid B2B and B2C approach appropriate, and how should you structure go-to-market motions for each model?

A hybrid B2B and B2C approach can work when products serve both audiences. Structure separate go-to-market motions, messaging, and pricing by audience while keeping a unified product roadmap and shared customer data.

Which metrics matter most for success under the B2B vs B2C business model, and how do they differ?

Metrics differ by model: B2B emphasizes pipeline velocity, win rate, average deal size, and LTV relative to CAC; B2C emphasizes conversion rate, customer lifetime value, churn, and digital funnel efficiency. Both require clean data, attribution, and ongoing optimization.

| Aspect | B2B | B2C |

|---|---|---|

| Who buys | Organizations; multiple stakeholders; larger, longer deals | Individual consumers; quicker decisions; emotion-driven |

| Purchase cycle | Longer cycles with procurement, risk checks, and integration considerations; ROI evidence matters | Shorter cycles; impulse-driven, brand affinity, promotions, easy checkout |

| Pricing & packaging | Tiered, value-based, contract-driven; longer payment terms; larger total contract values | Simple pricing; consumer wallets; frequent promotions; feature bundles for consumers |

| Marketing & Sales alignment | Account-based marketing, demand generation; case studies; precise lead/pipeline metrics | Brand awareness; rapid acquisition; loyalty programs; personalization |

| Go-To-Market signals | Complex integrations; high lifetime value; seat-based or enterprise pricing signals | Broad distribution; digital channels; potential for viral growth |

| Metrics that matter | Pipeline velocity, win rate, average deal size, LTV vs CAC | Conversion rate, customer lifetime value, churn, digital funnel efficiency |

| Hybrid/go-to-market approach | Some products suit B2B; separate motions by audience; unified product roadmap | Hybrid scenarios exist; separate messaging/pricing by audience; unified roadmap |

| Practical steps to decide & execute |

|

|

Summary

Key points table