Understanding fiscal policy and economic growth helps explain how governments’ choices about taxes, spending, and borrowing ripple through every corner of the economy, from the stability of family budgets to the vigor of local labor markets, and from the price level facing households to the resilience of small businesses during cycles of expansion and downturn, including the distributional effects on households, the incentives facing managers, and the role of credible rules that anchor expectations. By examining specific channels, analysts evaluate fiscal policy effects on jobs as infrastructure builds, education programs, targeted subsidies, and regulatory reforms shift the demand for labor, alter skill requirements, encourage entrepreneurship, raise productivity in tradable sectors, and improve the resilience of workers through retraining and mobility incentives. When government spending and GDP growth are synchronized with strategic investments—such as universal pre-K, modernized transit, digital infrastructure, renewable energy projects, and advanced manufacturing—the short-run demand boost can reduce unemployment more quickly while raising long-run productivity, which in turn supports higher potential output and broader living standards across regions. Researchers also consider tax policy impact on unemployment by examining how wage credits, earned income tax credits, deduction structures, social insurance design, and depreciation rules influence labor force participation, investment choices, entrepreneurship, regional development, and the allocation of talent across regions and firms, especially during recoveries from shocks. Finally, the interaction of public investment and growth with budget deficits and economic recovery highlights the need to balance ambitious, productivity-enhancing projects with prudent financing, ensuring that short-term stabilization does not crowd out private investment, erode fiscal credibility, or impair long-run macroeconomic resilience.

From a linguistic perspective, the same discussion can be framed using budgetary policy, public finance strategy, and macro stabilization without repeating the exact labels. Consider how government expenditures and revenue measures influence employment, productivity, and investment sentiment; terms like fiscal stance, public investment, and monetary posture together shape growth trajectories. In this LSId framing, keywords such as infrastructure outlays, human capital development, and tax incentives function as latent signals that connect policy choices to real-world outcomes. This approach helps readers and search engines see the relationships among deficits, debt management, credibility, and long-run prosperity, reinforcing the core idea that prudent budgeting and strategic investment support sustainable expansion.

The Core Link: Fiscal Policy and Economic Growth

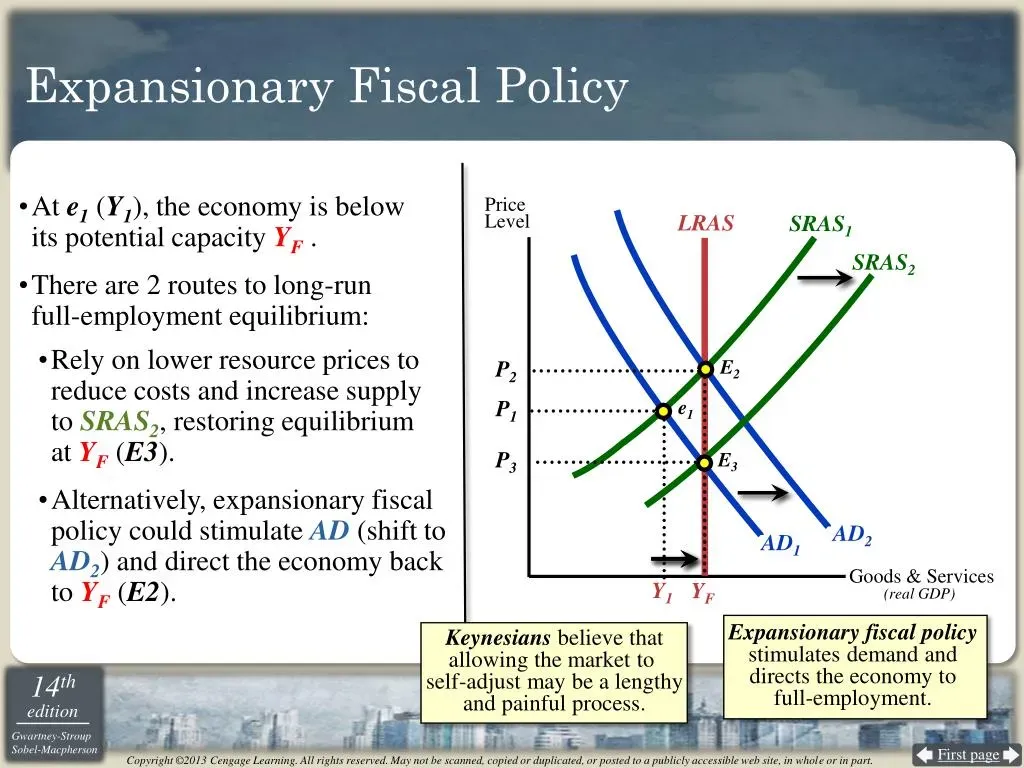

Fiscal policy and economic growth are intertwined because the government’s choices on taxation, spending, and borrowing directly influence demand, productivity, and the long-run productive potential of the economy. When policy-makers decide on tax rates, public spending, or deficits, they are not just balancing a budget; they are shaping the fiscal policy effects on jobs, wages, and the pace of growth.

The channels through which these choices operate include stabilizing demand in the short run and expanding productive capacity over the long run. The same fiscal policy that aims to stimulate employment also affects efficiency and innovation, tying together budget decisions, debt considerations, and the lived experiences of workers as the economy evolves.

Government Spending and GDP Growth: Demand and Capacity

Government spending and GDP growth are linked through both demand-stimulating effects in downturns and productivity-enhancing investments in infrastructure, education, and health. When the state funds roads or schools, it not only boosts current demand but also improves the economy’s potential output, helping more people find steady work.

Public investment and growth tend to be associated with higher total factor productivity and longer-run job creation, as improved infrastructure lowers costs and expands opportunities for firms to hire.

Tax Policy and Unemployment: Incentives, Work, and Wages

Tax policy impact on unemployment depends on how tax rates, credits, and deductions affect work incentives and labor force participation. Reducing barriers to employment or subsidizing training can lift participation rates and decrease unemployment, particularly during recoveries.

Policy design matters: tax reforms that encourage hiring and investment can increase private sector employment, while poorly targeted cuts may erode revenue and weaken fiscal resilience, reducing the effectiveness of stabilization.

Public Investment and Growth: Building Infrastructure and Human Capital

Public investment and growth: beyond immediate gains, targeted investments in roads, broadband, and research funding tend to raise long-run growth by expanding productive capacity and human capital.

Strategic public investment often yields higher multipliers when aligned with private investment, creating a compounding effect on job creation and wage growth.

Budget Deficits and Economic Recovery: Balancing Short-Run Support with Sustainability

Budget deficits and economic recovery: in downturns, deficits can support demand and shield jobs, but rising debt may raise financing costs and crowd out private investment if not managed carefully.

Balancing deficit-financing with credible rules and clear spending objectives can improve confidence and foster sustainable growth, shaping the pace of employment gains after a shock.

Designing Countercyclical Measures: Timing, Targeting, and Policy Effectiveness

Designing countercyclical measures: timing and targeting determine whether fiscal action stabilizes demand quickly and supports jobs, or fails to translate into meaningful improvement.

Effective design emphasizes productive spending, credible fiscal rules, and performance-tracking to ensure that multipliers from fiscal stimulus translate into wage gains and job creation.

Frequently Asked Questions

What are the fiscal policy effects on jobs and economic growth?

Fiscal policy shapes both short‑term job creation and long‑run growth through several channels: spending and transfers to stabilize demand, tax policy to influence work incentives and investment, and public investment that raises productivity. Debt management also matters, as sustainable borrowing supports growth without crowding out private investment. The overall impact depends on timing, design, and the economy’s condition.

How do government spending and GDP growth interact under fiscal policy?

Targeted government spending—especially on infrastructure, education, and health—can raise GDP growth by expanding productive capacity and creating jobs in the near term, while boosting long‑run potential. Well‑designed public investment tends to yield higher multipliers, but deficits and misallocation can crowd out private investment if not carefully managed.

What is the tax policy impact on unemployment within fiscal policy and growth?

Tax policy affects unemployment by shaping work incentives, labor supply, and human capital development through credits and deductions. Lower taxes on labor and supportive training incentives can raise participation and earnings, contributing to faster job growth, provided revenue and macro conditions remain sustainable.

Why is public investment critical for growth in fiscal policy?

Public investment in infrastructure, education, and research and development raises productivity and expands the economy’s growth potential, supporting durable job creation. The effectiveness depends on targeting, efficiency, and complementary reforms that enhance private-sector activity.

How do budget deficits and economic recovery shape jobs and stability?

Deficits can provide demand support during downturns, aiding economic recovery and protecting jobs. However, sustained, high deficits raise interest costs and can crowd out private investment, underscoring the need for credible rules and sustainable debt management to maintain growth and employment.

What is the role of fiscal policy in promoting economic growth and job creation?

A balanced approach uses stabilization tools during recessions alongside productive investments and prudent debt management to foster sustainable economic growth and employment. Coordinating fiscal policy with monetary policy can amplify demand without compromising price stability.

| Aspect | Key Points | Impact on Growth/Jobs |

|---|---|---|

| Goals of fiscal policy | Stabilize the economy in the short run; raise productive capacity in the long run through public investment, human capital, and innovation. | Supports job creation and productivity; stabilizes demand cycles. |

| Channels | Spending/public investment; Tax policy; Transfers/automatic stabilizers; Debt/deficits. | Direct demand, incentives for work/investment, income stabilization, and financing considerations affect employment and growth. |

| Design & Timing | Countercyclical measures; targeted high-return spending; policy mix matters. | Better multipliers; faster recovery; sustainable long-run growth. |

| Balanced Approach | Trade-offs between stabilization and long-run growth; deficits vs debt sustainability; credible rules. | Predictable policy improves business planning and employment outcomes. |

| Monetary-Fiscal Interaction | Coordination can amplify impact; misalignment can dampen effects. | Enhanced or reduced job creation depending on policy stance. |

| Evidence & Tools | Infrastructure, education, R&D, tax incentives; equitable rules; governance. | Higher multipliers, improved labor quality, and longer-run growth when well-implemented. |

| Risks & Governance | Debt sustainability, inflation risk, spending efficiency, distributional effects. | Potential drag on growth if mismanaged; emphasis on efficiency yields better employment outcomes. |

| Global Context | Institutions, openness, international conditions; credibility and implementation speed. | Policy effectiveness shaped by external conditions and governance. |