Politics for Small Business is more than a debate about lawmakers and ballots; it’s a practical element of everyday strategy. Small business owners constantly weigh policy changes and SMB operations, regulatory deadlines, and potential tax shifts against growth plans, hiring, and cash flow. Industry shifts at federal, state, and local levels can affect expansion, technology adoption, and market reach in the broader regulatory landscape SMBs navigate. This guide shows how policy awareness translates into practical steps that support budgeting, hiring, and customer trust. By staying informed and adaptable, SMBs can turn regulatory insight into a strategic advantage for sustainable growth and resilience.

Beyond the headlines, the policy landscape that guides small business activity acts as the invisible roadmap for day-to-day decisions. Owners weigh legislative shifts, compliance expectations, and public program timelines while planning hiring, sourcing, and product development. The broader governance climate, including business regulations, shapes access to capital, supplier networks, and customer trust, turning regulatory nuance into competitive leverage. Understanding this regulatory climate and related governance requirements helps SMBs forecast costs, minimize risk, and seize opportunities embedded in public policy.

The Regulatory Landscape and Its Impact on Small Business Growth

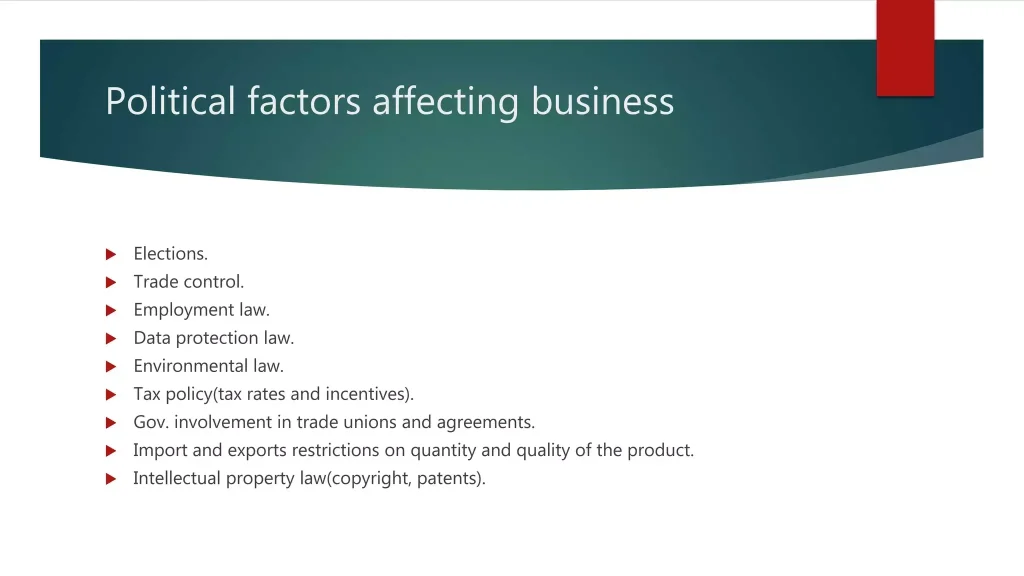

The regulatory landscape shapes decisions from hiring to capital expenditure. The impact of legislation on small business growth is visible in tax policy shifts, labor standards, and export controls that either unlock opportunities or raise barriers.

Understanding the regulatory environment for SMBs helps forecast headwinds and identify openings, guiding budgeting, pricing, and expansion plans with fewer surprises.

Politics for Small Business: Turning Policy into Competitive Growth

In practice, Politics for Small Business is about translating policy changes and SMB operations into actionable growth strategies. By tracking how proposed rules will affect hiring, taxation, and contracting, owners position their businesses to capitalize on favorable shifts.

This approach also means recognizing how policy signals influence customer trust, supplier negotiations, and access to capital, turning governance into a competitive advantage.

Small Business Compliance as a Growth Engine

Small business compliance is often perceived as a cost center, but when embedded in strategy it becomes a growth engine. Clear policies, staff training, and automated monitoring help turn regulatory obligations into predictable, scalable operations.

A robust compliance program reduces disruptions, improves supplier and customer confidence, and can unlock opportunities in contracts and financing that reward responsible operation.

Business Regulations: Balancing Costs and Opportunity

Business regulations define what a company can do and at what cost, shaping licensing, reporting, and audit requirements against the backdrop of growth goals. Smart compliance reframes these costs as investments in reliability and market access.

When regulation is managed proactively, the day-to-day burden becomes a predictable cost of doing business, enabling smoother scale, fewer penalties, and a more compelling offer to customers and partners.

Regulatory Environment for SMBs: Preparing for Policy Changes and SMB Operations

Staying ahead means mapping how policy proposals will affect payroll, data privacy, environmental handling, and trade—core elements of the regulatory environment for SMBs. Anticipating rules reduces risk and supports steady growth.

Develop living playbooks that align with new rules, connect compliance to day-to-day workflows, and keep operations resilient as rules evolve across federal, state, and local levels.

Practical Playbook: Monitoring Policy Changes to Drive Growth

A policy-monitoring routine is the first step in turning regulation into growth. Assign responsibility to track developments at multiple levels, subscribe to credible newsletters, and participate in industry groups that summarize deadlines and implications.

Next, map regulatory obligations to business processes, invest in a flexible compliance toolkit, and build scenario plans that test growth strategies under different policy environments. This practical approach embeds policy awareness into every growth decision.

Frequently Asked Questions

What is Politics for Small Business and why does it matter for growth?

Politics for Small Business is the link between policy decisions and everyday entrepreneurship. It tracks how legislation and the regulatory environment influence growth, hiring, cash flow, and technology adoption. By treating policy awareness as a core strategic capability, SMBs can anticipate changes and align investments with expected outcomes.

How does the regulatory environment for SMBs influence daily operations and long-term planning?

The regulatory environment for SMBs shapes labor, tax, privacy, environmental, and other rules that guide your day-to-day work and planning. Staying current helps forecast headwinds and openings, while a proactive compliance posture reduces disruption and speeds scaling.

In what ways does small business compliance turn policy into a competitive advantage?

Small business compliance is a growth enabler. Strong programs reduce risk, improve customer and supplier confidence, and open doors to contracts and financing that reward responsible operation, turning policy requirements into differentiation.

How can policy changes and SMB operations be mapped to growth strategies?

Map obligations to business processes by creating a living regulatory map for payroll, data handling, and product safety, then align it with operational playbooks. Regular policy monitoring and scenario planning help you time launches and allocate capital under changing rules.

What practical steps can SMBs take to navigate the impact of legislation on small business growth?

Build a policy-monitoring routine across federal, state, and local levels; map regulatory obligations to processes; invest in a flexible compliance toolkit; develop scenario plans; engage with policymakers and industry groups; align procurement practices with governance expectations; and prepare for audits to sustain investor and customer confidence.

How do business regulations and tax incentives affect growth and access to funding for SMBs?

The impact of legislation on small business growth shows up in tax policy changes and incentives that affect profitability and capital for reinvestment. By leveraging credits, deductions, and subsidies while maintaining compliance, SMBs can accelerate hiring, equipment upgrades, and market expansion.

| Section | Key Points |

|---|---|

| Introduction |

|

| The Connection Between Politics, Growth, and Compliance |

|

| The Regulatory Landscape Small Businesses Face |

|

| The Impact on Growth and Operational Agility |

|

| Compliance as a Growth Enabler |

|

| Key Areas to Watch |

|

| Practical Steps for SMBs to Navigate Legislation |

|

| Real-World Scenarios |

|

| Case Studies |

|

Summary

Politics for Small Business is the bridge between governance and everyday entrepreneurship. By understanding how legislation shapes growth and compliance, SMBs can plan strategically, invest wisely, and build resilience against policy shifts. A proactive approach to monitoring policy changes, implementing a scalable compliance program, and engaging with the broader business ecosystem transforms regulatory risk into an engine for smarter growth. For small businesses, the most important takeaway is clear: stay informed, adapt quickly, and align operations with policy realities to unlock opportunities, manage risk, and achieve sustainable success in a dynamic political and regulatory environment.