World Economy 2026 is entering a phase of cautious expansion after years of volatility. Analysts tracking world economy 2026 trends note inflation normalization, shifting supply chains, and the ongoing digital and green transitions. The global economic outlook 2026 suggests more predictable monetary conditions, even as regional divergences require careful risk management. Investors are mapping 2026 investment opportunities across energy, technology, and healthcare, seeking durable gains amid policy normalization. As the landscape evolves, recognizing economic risks 2026 and the evolving market opportunities 2026 can help safeguard portfolios.

Viewed through alternate vocabularies, the coming year’s macro climate for the world economy can be seen as a transition from acute inflation to steady normalization, with supply chains reconfiguring and digital adoption accelerating. This broader international market landscape emphasizes the same forces—policy clarity, capital flexibility, and the shift toward services, tech, and sustainable energy. From a macro outlook for 2026 to the next year’s growth trajectory, investors and firms will watch real interest paths, currency dynamics, and geopolitical risk as framing conditions. Understanding the broader global growth backdrop, the global business environment, and the regional cycles helps identify resilient opportunities in infrastructure, AI-enabled services, and clean technologies.

World Economy 2026: Trends Shaping Growth and Transformation

The World Economy 2026 is transitioning from volatility to cautious expansion as inflation normalizes and policy becomes more predictable. The world economy 2026 trends point to a shift toward services, technology, and green energy, with demand patterns diverging across regions. The global economic outlook 2026 reinforces expectations of gradual policy normalization, helping anchor long-duration investments in infrastructure and renewables while maintaining flexibility for cyclical fluctuations. For investors, these dynamics signal the emergence of 2026 investment opportunities across multiple themes.

Looking ahead, the world economy 2026 trends emphasize resilience through diversified supply chains, digital adoption, and human capital development. Regions that accelerate energy transition, AI deployment, and climate policy alignment are likely to outperform, creating market opportunities 2026 for agile firms and patient capital. This framework requires robust risk management and scenario planning to identify sectoral winners and align portfolios with evolving consumer preferences.

Global Economic Outlook 2026: Inflation, Rates, and Policy Normalization

In the global economic outlook 2026, inflation remains contained in many advanced economies, allowing central banks to pursue gradual rate normalization and balance sheet adjustments. This environment supports investment activity and provides greater clarity on borrowing costs for long-term projects, consistent with the broader themes of world economy 2026. As policy settings gradually normalize, investors can pursue steadier risk-adjusted returns across infrastructure, tech, and energy transition plays.

Policy divergence across regions remains a key hurdle, requiring careful monitoring of fiscal stances, debt sustainability, and currency movements. The global economic outlook 2026 suggests diversification and liquidity management as core strategies to unlock 2026 investment opportunities while mitigating downside. Sectors tied to productivity gains—such as AI, cybersecurity, cloud services, and renewable energy—offer clear market opportunities 2026 for strategic allocations.

Investment Opportunities in 2026: Sectors and Themes to Watch

Across energy, technology, and healthcare, the 2026 investment opportunities landscape remains broad and multi-speed. The energy transition drives demand for clean generation, grid modernization, and energy storage, while technology enablers like AI, edge computing, and semiconductors expand productivity and create new monetization models. This mix aligns with the broader world economy 2026 trends and highlights where patient capital can be deployed in the coming years.

Emerging markets offer compelling upside as rising middle classes adopt digital tools and modern services, though investors should weigh political risk, currency stability, and regulatory environments. Smart mobility, urban resilience, and data infrastructure present market opportunities 2026 for firms capable of scaling with policy support and long‑term project finance. A diversified approach across defensives and cyclicals remains essential to balance resilience with upside.

Economic Risks 2026: Debt, Geopolitics, and Climate Disruption

Economic risks 2026 include elevated debt levels in many countries, policy missteps, and energy price volatility that can ripple through consumer spending and corporate margins. Geopolitical tensions and sanctions add volatility to trade routes, energy markets, and cross-border investment flows. The world economy 2026 does not hinge on a single outcome, so risk assessment and hedging remain crucial for portfolios and corporate planning.

Climate-related disruption introduces near-term headwinds for some sectors while unlocking opportunities in renewables, transmission infrastructure, and resilience services. Currency fluctuations and capital flows can complicate earnings outlooks for multinational firms, underscoring the need for diversified exposure and scenario planning as part of a robust approach to economic risks 2026.

Market Opportunities 2026: Regions and Sectors with Growth Potential

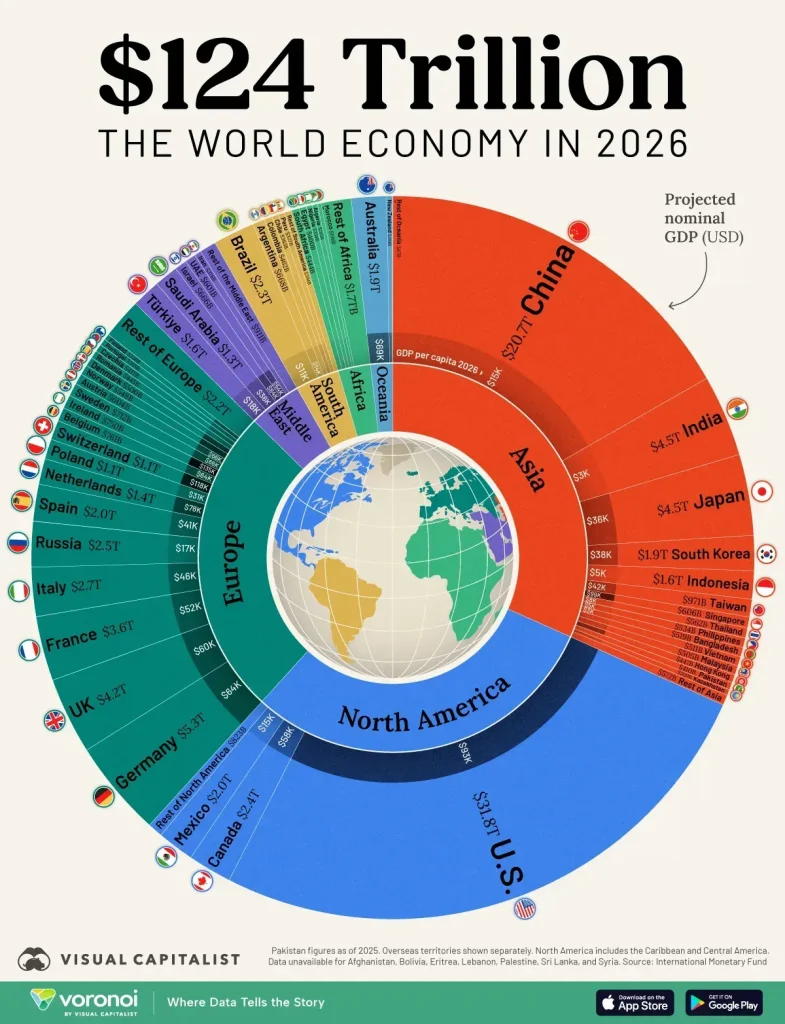

Regional dynamics create distinct market opportunities 2026, with the US anchored by services, technology, and energy innovation, Europe emphasizing green manufacturing and digital services, and Asia driving growth through a growing digital economy and favorable demographics. These regional narratives shape how capital allocators calibrate risk and pursue return. Investors should tailor strategies to regional policy support, currency cycles, and supply-chain resilience to capture upside.

Emerging markets offer longer-term potential as middle-class consumers embrace new technologies and services, though they require careful assessment of inflation differentials, capital-flow volatility, and regulatory environments. Market opportunities 2026 in these regions often come with higher upside and greater volatility, so a disciplined approach to leverage, local partnerships, and governance is essential for sustainable returns.

Preparing for the World Economy 2026: Strategy, Diversification, and Risk Management

To navigate the World Economy 2026, practitioners should adopt scenario planning, testing three plausible paths for growth, inflation, and policy settings, then adjusting allocations accordingly. A disciplined framework links asset allocation to resilience, liquidity, and risk controls, enabling investors to capture opportunities while limiting drawdowns. This approach aligns with the global risk landscape outlined in the world economy 2026 narratives and supports long-horizon planning.

Businesses should hedge commodity and currency exposures, invest in resilience, and align supply chains with regional strengths to strengthen competitive positioning in a changing global market. Staying informed about policy shifts and maintaining liquidity will help portfolios weather volatility highlighted by the global economic outlook 2026, while pursuing targeted 2026 investment opportunities in energy, tech, and healthcare innovation.

Frequently Asked Questions

What are the World Economy 2026 trends shaping growth across regions?

The World Economy 2026 trends point to a gradual normalization after a period of high inflation and tight policy. In the US, growth remains steady; the EU expands modestly with strong services and diversified exports, and Asia is driven by India and Southeast Asia. Growth is increasingly led by services, technology, and green energy rather than traditional manufacturing. Monetary policy is gradually normalizing, inflation remains contained, and regional policy differences and debt levels require careful risk monitoring.

How does the global economic outlook 2026 affect investor strategies?

The global economic outlook 2026 suggests a more predictable environment for investment as inflation stays contained and policy rates normalize gradually. Borrowing costs for long-term projects such as infrastructure and renewable energy become more predictable, supporting planning and capital allocation. Investors should diversify across geographies, sectors, and assets, and employ scenario planning to test portfolios under different growth and policy paths.

Where are the 2026 investment opportunities most compelling for portfolios?

Key 2026 investment opportunities include the energy transition and grid modernization, with demand for clean generation, storage, and related infrastructure. Technology enablers such as AI, cybersecurity, cloud platforms, and semiconductors remain central to productivity gains. Healthcare innovation and sustainable mobility, urbanization, and smart cities also offer growth, particularly in markets with evolving demographics and digital adoption.

What are the key economic risks 2026 that could derail expansion?

Economic risks 2026 include high debt levels in many countries, potential policy missteps, and geopolitical tensions that can disrupt trade and energy markets. Energy price volatility and currency fluctuations can affect margins and earnings, while climate-related disruptions can create near-term headwinds for certain sectors. Robust risk management, scenario planning, and diversified exposure are essential.

Which market opportunities 2026 are expected to drive returns in technology and energy?

Market opportunities 2026 are expected to flow from digital infrastructure and green energy investments, including data centers, fiber networks, and 5G/6G capabilities, as well as renewables, storage, and grid modernization. AI, cybersecurity, and cloud services will boost productivity and create new monetization models. Sustainable mobility and smart city initiatives also offer resilient, long-horizon returns with regional diversification to manage risk.

What steps should investors take to align with World Economy 2026 trends?

Investors should use scenario planning, diversify across geographies and assets, and maintain liquidity to seize opportunities as they arise. Align portfolios with energy transition and digital transformation themes, and hedge commodity and currency exposures where appropriate. Monitor policy shifts and regional dynamics, and focus on resilience and capital-intensive projects that benefit from longer investment horizons.

| Section | Key Points | Notes / Implications |

|---|---|---|

| Introduction | World Economy 2026 context: cautious expansion; inflation normalization; digital tech and green energy transition. | Sets the stage for trends and opportunities. |

| Global Trends Shaping the World Economy 2026 | Gradual normalization after high inflation; US growth steady but softer; EU modest expansion; Asia contributions; shift toward services, technology, and green energy. | Underpins investment and policy focus. |

| Monetary Policy and Inflation Dynamics | Inflation contained; gradual rate normalization; balance-sheet reduction; more predictable monetary regime; uneven regional policy alignment; monitor fiscal stance and debt. | Implications for borrowing costs and project finance. |

| Structural Shifts | Energy transition, climate policy, AI, cloud, data analytics; digital transformation and green capital; demographics shaping productivity; cross-border collaboration; investment in human capital and infrastructure. | Supports long-run growth and sector reallocation. |

| Global Trade Patterns | Diversification and re-shoring; regionalized strategies; agility and data-driven decision-making; align portfolios with evolving consumer preferences; risks from geopolitics and energy price volatility. | Rationale for regional supply chains and risk management. |

| Risks and Resilience: Economic Risks 2026 | Elevated debt; policy missteps; geopolitical tensions; energy price swings; climate disruption; currency fluctuations; need for risk management, scenario planning, diversified exposure. | Strategic hedging and resilience required. |

| Investment Opportunities in 2026: Where to Look | Energy transition and decarbonization; technology enablers (AI, cybersecurity, cloud, semiconductors); healthcare innovation; sustainable mobility and smart cities; opportunities in emerging markets; diversified defensives/cyclicals. | Guides portfolio construction. |

| Regional and Sectoral Outlooks | US: cornerstone; Europe: services, manufacturing, green infra; Asia: China slower but significant, India expanding; Emerging markets: attractive long-term but risk; sector view: renewables, digital infra, healthcare innovation. | Regional allocation insights. |

| Practical Guidance: How to Prepare for World Economy 2026 | Scenario planning; diversification; maintain liquidity; hedging; invest in resilience; align supply chains; monitor policy shifts. | Actionable steps for portfolios and businesses. |

Summary

World Economy 2026 opens with a balanced yet dynamic panorama of global growth, policy normalization, and a decisive shift toward energy transition and digital transformation. The outlook suggests cautious expansion after years of volatility, with inflation largely contained and borrowing costs moving toward normality, supporting infrastructure and innovation investments. Regions diverge in pace—America’s steady demand, Europe’s services-led resilience, and Asia’s contribution from India and Southeast Asia—while global trade becomes more regionally oriented and risk-aware. The growth engine increasingly centers on high-value services, technology, and green capital, complemented by enhanced human capital and infrastructure spending. For investors and businesses, the path forward emphasizes scenario planning, diversification across geographies and sectors, prudent liquidity management, and resilience-building strategies to navigate potential shocks and seize opportunities in the coming years.