World Economy Indicators provide a clear lens into the forces shaping markets, policymakers, and investors worldwide, helping teams align risk, strategy, and capital with emerging realities. They assemble a compact set of measures—such as global economic indicators, the GDP growth rate, and inflation trends—to reveal momentum across regions and sectors, improving forecast accuracy for decisions, to help readers interpret cross-border shifts and policy changes. By watching the unemployment rate alongside central bank policy signals, analysts can gauge how policy shifts may ripple through earnings, wages, and investment, influencing financing conditions and project viability. This descriptive framework helps translate raw data into signals you can act on, from budgeting and risk management to strategic planning, scenario analysis, and long-term capital allocation for executives and analysts alike. Whether you are evaluating a mature economy or an emerging market, these indicators offer a repeatable, decision-ready view of macro health that guides stakeholders through volatility and gradual change in rapidly changing markets.

Looking beyond the exact label, the same idea can be framed through macroeconomic data, global indicators, and market signals that reveal the health of economies across regions. From the lens of macro signals and market sentiment, you see how expansion rates, price pressures, and job-market conditions align to steer policy and investment. Policy guidance emerges when central bank stances, currency moves, and credit conditions interact with output momentum, providing a nuanced view of risk and opportunity. In short, the same core story is told through different terms, helping audiences discover the underlying patterns without relying on a single label.

1. World Economy Indicators: A Global Dashboard for Investors and Policymakers

World Economy Indicators function as a global dashboard that aggregates critical data into a readable snapshot of economic health. By pulling together metrics from trusted sources, these indicators help investors gauge risk, policymakers assess policy effectiveness, and business leaders plan accordingly. The emphasis on a concise, repeatable set of measures makes it easier to separate signal from noise in an environment of rapid information flow and complex market dynamics.

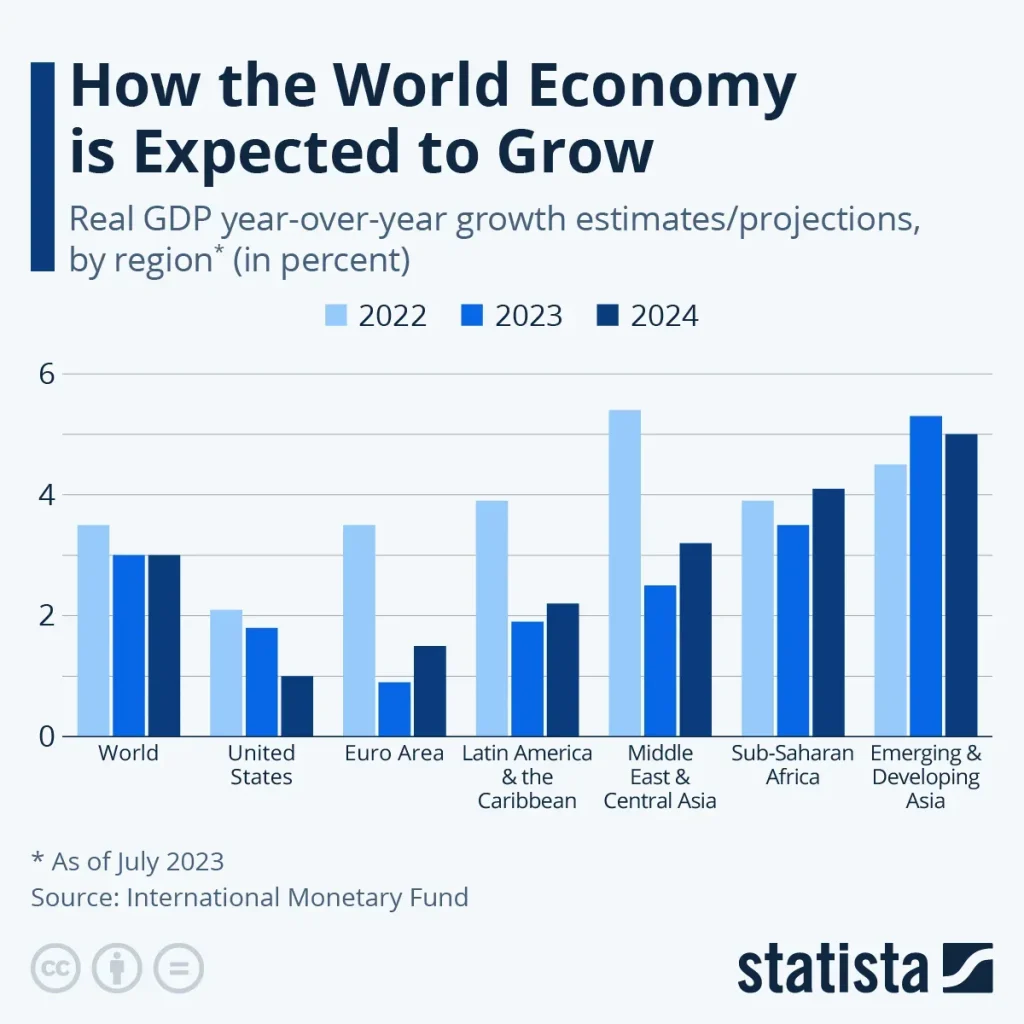

In practice, World Economy Indicators enable comparisons across regions—from advanced economies to emerging markets—so stakeholders can spot where growth is strongest, where inflation is rising, and how policy shifts may ripple through trade and capital flows. This global perspective reveals how shocks in one corner of the world can propagate, influencing pricing, financing conditions, and risk premiums across borders.

2. GDP Growth Rate and Inflation Trends: Core Signals of Economic Momentum

The GDP growth rate is the primary yardstick for measuring how quickly an economy is expanding or contracting. Interpreting the pace of growth requires looking beyond a single number to understand momentum, sustainability, and capacity pressures. A solid growth rate can support jobs and incomes, but if it accelerates too quickly it may tighten supply chains and push inflation higher.

Inflation trends provide the complementary lens, revealing how quickly prices for goods and services are rising and affecting consumer purchasing power. Stable inflation supports predictable planning, while rising inflation can prompt central bank policy adjustments. Tracking inflation trends alongside GDP growth rate helps you anticipate scenarios for interest rates, bond yields, and the real return on investments.

3. Unemployment Rate and Global Context: Labor Markets in Focus

The unemployment rate serves as a direct barometer of labor market health, influencing household income, consumer demand, and confidence. When job creation is strong, households tend to spend more, fueling growth and reinforcing positive momentum. Conversely, higher unemployment can dampen consumption and slow expansion, prompting policy responses aimed at stabilizing markets.

Beyond the domestic picture, the unemployment rate must be considered with labor force participation and underemployment to form a complete view of labor dynamics. Global context matters: regional disparities and sectoral shifts can distort headline figures, so analysts watch how unemployment interacts with global economic indicators and currency movements to gauge policy implications and cross-border demand.

4. Central Bank Policy: Its Implications for Credit, Rates, and Confidence

Central bank policy shapes the cost and availability of credit, influencing investment, spending, and exchange rates. Decisions on policy rates, quantitative easing, and reserve requirements interact with GDP growth rate and inflation trends to determine the trajectory of the economy. A tightening stance can cool overheating growth and curb inflation, while easing can stimulate demand when inflation is subdued.

Understanding central bank policy helps you interpret market reactions to macro data and forecast future paths for interest rates, bond yields, and currency values. The dialogue between policy actions and the core indicators—GDP growth rate, inflation trends, and unemployment rate—creates a narrative that guides investors, businesses, and policymakers in risk assessment and strategic planning.

5. Global Economic Indicators: Reading Cross-Border Signals and Synchronization

Global economic indicators provide context by aggregating data from multiple economies, showing whether growth is synchronized or diverging across regions. This cross-border perspective helps explain how global demand, commodity prices, and capital flows influence domestic inflation and growth. Investors and policymakers use these signals to assess exposure to international risks and opportunities.

When major economies move in tandem, currencies and trade patterns can align in predictable ways; when they diverge, capital reallocations and volatility can rise. Analyzing global economic indicators alongside regional specifics helps you anticipate how shocks—such as commodity price swings or policy shifts—may ripple through markets and alter risk premia.

6. Turning Data into Decisions: Practical Reading and Decision-Making Framework

A practical framework starts with a core set of indicators and a clear objective, whether it’s investing, risk management, policy planning, or corporate strategy. Build a dashboard that presents GDP growth rate, inflation trends, unemployment rate, global economic indicators, and central bank policy in a way that highlights momentum, direction, and turning points. Regularly gather data, align it with market context, and set rules for alerts and thresholds.

To translate signals into actions, you should compare regions and sectors, test scenarios, and maintain flexibility as conditions evolve. Translating data into concrete decisions—such as portfolio adjustments, pricing, or capital allocation—requires combining quantitative trends with qualitative context, including geopolitical developments and supply-side constraints. This disciplined approach helps risk manage and seize opportunities in a dynamic global economy.

Frequently Asked Questions

What are World Economy Indicators and how do they relate to the GDP growth rate and inflation trends?

World Economy Indicators are a suite of data points from IMF, World Bank, OECD and national statistical agencies that track global economic performance. They prominently include the GDP growth rate and inflation trends, helping compare regions, detect turning points, and guide investment or policy decisions. Understanding them helps separate signal from noise in a complex global economy.

How can global economic indicators help interpret unemployment rate trends across different regions?

Global economic indicators synthesize data from multiple economies, enabling cross-country comparisons of unemployment rate trends. By analyzing unemployment alongside regional growth signals, you can identify areas with labor slack or tightness, anticipate policy responses, and tailor workforce planning and risk management accordingly.

Why is central bank policy crucial when analyzing GDP growth rate alongside inflation trends?

Central bank policy shapes how GDP growth rate translates into inflation trends through interest rates and other monetary tools. When inflation trends rise, policy may tighten to prevent overheating; when inflation is subdued, policy may ease to support growth. Pairing central bank policy with GDP growth rate and inflation trends helps forecast monetary conditions and asset price movements.

How do global economic indicators relate to regional differences in growth and inflation within the World Economy Indicators framework?

Global economic indicators capture how synchronized or divergent growth and inflation are across regions. They reveal how a regional uptick or slowdown affects trade, currency movements, and capital flows. Comparing these indicators helps interpret cross-border risks and opportunities for investment and policy calibration.

What practical steps can I take to read GDP growth rate, inflation trends, and central bank policy for decision-making?

Build a practical dashboard that tracks GDP growth rate, inflation trends, unemployment rate, and central bank policy, alongside broader global economic indicators. Assess direction and momentum, set thresholds, and translate signals into actions for investment, pricing, or policy planning. Regular interpretation helps turn data into timely decisions.

How frequently should I monitor World Economy Indicators to stay ahead of turning points?

Monitor World Economy Indicators on a monthly basis for headline metrics and momentum, with a quarterly review to interpret trends and assess policy implications. Supplement with timely surveys and market signals to catch turning points early and adjust strategies accordingly.

| Aspect | Key Points |

|---|---|

| What are World Economy Indicators? |

|

| Why track World Economy Indicators? |

|

| Core indicators to watch |

|

| Unemployment rate and global economic indicators |

|

| Central bank policy and its implications |

|

| How to read trends: turning data into decisions |

|

| Practical tracking: building a robust monitoring routine |

|

| Industry implications and regional nuances |

|

| Putting it all together: a practical framework for readers |

|

Summary

World Economy Indicators provide a descriptive lens into the health and direction of the global economy. By focusing on a core set of measures — GDP growth rate, inflation trends, unemployment rate, global economic indicators, and central bank policy — you can map how economies are expanding, stabilizing, or overheating, and where policy may shift. These indicators act as a dashboard that helps investors, policymakers, and businesses anticipate turning points, allocate resources, and manage risk. A holistic view across regions and sectors reveals how shocks in one area ripple globally, guiding strategic decisions and policy calibration. In practice, consistent monitoring, contextual interpretation, and timely action turn data into actionable insight for sustainable growth.