Financial forecasting for small businesses is more than a numbers exercise—it’s a compass that guides daily decisions and long-term resilience, helping owners stay focused when plans shift. The practice links cash flow forecasting with small business budgeting, turning forecasts into practical spending plans that protect payroll, cover essential expenses, and fund shared priorities. With a clear forecast, profit planning becomes concrete, and leaders can test growth strategy against available resources rather than rely on gut instinct alone. Treating forecasting as a living tool improves communication with lenders and investors, and it shifts decision-making from guesswork to evidence-based, scenario-aware action. In environments where every dollar matters, disciplined forecasting builds momentum toward sustainable profitability and informed growth, turning ambition into measurable, repeatable results.

Across industries, this predictive discipline relies on revenue projections, expense outlooks, and timing to map how funds move through operations over a 12- to 24-month horizon. It ties budgeting activities to strategic aims, showing when investments in people, equipment, or marketing yield tangible returns and how liquidity supports day-to-day needs. By modeling best, expected, and pessimistic cases, owners gain a realistic growth outlook and a plan for managing cash gaps without sacrificing core objectives. Techniques such as driver-based forecasting, rolling forecasts, and scenario analysis empower teams to test assumptions, adapt quickly, and communicate expected outcomes clearly. The result is a transparent roadmap that guides financing decisions, operational efficiency, and steady profitability, while keeping stakeholders aligned around shared goals.

1) Financial forecasting for small businesses: foundations and importance

Financial forecasting for small businesses serves as the compass that translates ambition into actionable numbers. It anchors decisions in data, guiding how revenue, expenses, and timing align with available resources. By translating forecasted revenue into projected profits, owners gain clarity about when investments will pay off and how much cash should be reserved for contingencies. This foundation helps establish discipline, reduce guesswork, and create a language of financial health that stakeholders can trust.

Beyond predicting the next quarter, this forecasting discipline informs daily operations and strategic choices. It ties into small business budgeting by turning high-level aims into concrete spending plans, cash flow needs, and staffing considerations. When used as an ongoing tool, financial forecasting strengthens lender and investor communications, demonstrating a disciplined approach to profitability and growth strategy that can unlock favorable financing and partnerships.

2) Integrating cash flow forecasting with small business budgeting for stability

Cash flow forecasting shows when money enters and leaves the business, highlighting timing gaps that can threaten operations. When combined with small business budgeting, it creates a cohesive plan that Visualizes not just what will be earned, but when it will be available to cover payroll, suppliers, and debt service. This integration helps prevent mid-month cash crunches and reduces reliance on last-minute financing by aligning receipts with expenses.

A robust approach connects cash flow forecasts to budgeting decisions across departments. For example, marketing spend, hiring plans, and capital purchases are all weighed against projected cash availability. By modeling different scenarios, owners can maintain liquidity while pursuing growth opportunities, ensuring that capital allocation supports both short-term stability and long-term profitability.

3) Building a resilient growth strategy through scenario planning and rolling forecasts

Scenario planning and rolling forecasts are powerful tools for embedding growth strategy into day-to-day planning. By creating base, optimistic, and pessimistic cases, small businesses can stress-test revenue streams, cost structures, and capital needs under varying market conditions. This approach reveals whether growth initiatives—such as new product lines or market entries—are financially viable and how long it will take to reach break-even.

Rolling forecasts keep the plan current by updating assumptions as new data arrives. This dynamic process ensures that the growth strategy remains relevant in the face of seasonality, competitive shifts, and economic changes. With an adaptable forecast, leaders can pivot quickly, reprioritize investments, and maintain profitability while pursuing expansion.

4) Profit planning as the engine of sustainable profitability for small firms

Profit planning translates revenue forecasts and cost expectations into expected margins, helping owners decide whether pricing, product mix, or supplier terms require adjustment. By focusing on gross and net margins, this practice reveals where profitability is strongest and where costs can erode earnings. Profit planning acts as a steady guide, ensuring that ambition does not outpace financial reality.

Effective profit planning requires visibility into both fixed and variable costs. It prompts ongoing dialogue about pricing strategies, channel profitability, and operational efficiencies. When profit planning is integrated with cash flow forecasting, leadership gains a clear view of how investment decisions will impact short-term liquidity and long-term profitability, reinforcing sustainable growth.

5) Tools, methods, and practical steps to craft a robust forecast

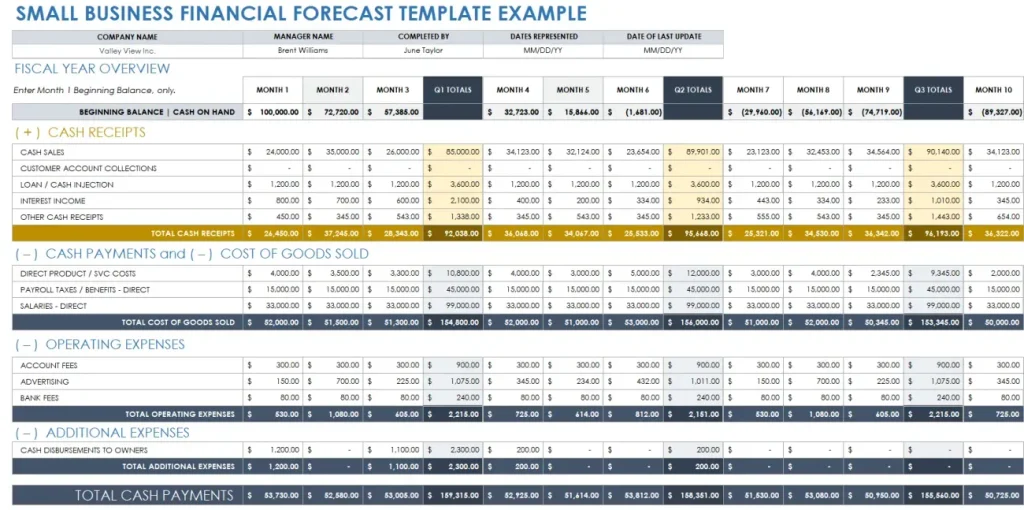

Developing a reliable forecast starts with gathering high-quality historical data and identifying the drivers that most influence revenue and costs. A practical mix of budgeting and forecasting methods—ranging from simple trend analysis to driver-based forecasting—helps scale accuracy as the business grows. This blend supports a coherent plan that reflects realistic expectations and minimizes surprises.

Practical steps include defining a monthly forecast horizon (often 12–24 months), building scenario analyses, and linking forecasts to the budgeting process. Tools range from spreadsheet-based models to lightweight forecasting software that supports version control and collaboration. The emphasis should be on clarity, repeatability, and the ability to run what-if analyses quickly, so teams can act on insights rather than wade through complex data.

6) Measuring success: KPIs, governance, and communicating forecasts to stakeholders

A forecast’s value is amplified when paired with clear KPIs that connect financial results to operational performance. Key metrics such as gross margin, operating margin, burn rate, working capital, and days sales outstanding help quantify profitability and liquidity. Establishing governance around the forecast—how often it is updated, who owns assumptions, and how results are reviewed—keeps the process disciplined and credible.

Communicating forecasts to lenders, investors, and team members is essential for alignment and confidence. Presenting key takeaways, scenario implications, and the rationale behind changes makes the forecast a shared tool rather than a niche document. When stakeholders understand how forecasting informs growth strategy, budgeting decisions, and capital planning, the organization can act with coherence and pace.

Frequently Asked Questions

What is financial forecasting for small businesses and why does it matter?

Financial forecasting for small businesses is the practice of projecting revenue, expenses, and cash flow over a future horizon (typically 12–24 months) to guide decisions. It matters because it helps predict profitability, plan funding needs, schedule cash inflows and outflows, and align growth with available resources. By turning assumptions into a living forecast, owners can spot risks early, adjust pricing or costs, and communicate more confidently with lenders or investors.

How does small business budgeting influence financial forecasting for small businesses?

Small business budgeting provides the baseline inputs for financial forecasting for small businesses. A budget sets planned expenses and capital needs, while the forecast translates those plans into expected cash flow and profitability scenarios. Integrating budgeting with forecasting improves accuracy, highlights funding gaps, and guides resource allocation across the plan horizon.

What is cash flow forecasting, and how does it support liquidity in financial forecasting for small businesses?

Cash flow forecasting is the process of predicting when cash will come in and go out. In financial forecasting for small businesses, it reveals timing gaps between receipts and payments, helping you schedule payroll, debt service, and supplier payments. It supports liquidity by highlighting shortfalls early, enabling actions such as collections acceleration, vendor negotiations, or short-term financing before problems arise.

What is profit planning within financial forecasting for small businesses?

Profit planning is the part of forecasting that projects gross and net margins based on revenue and cost assumptions. In financial forecasting for small businesses, it helps you test pricing strategies, product mix, and cost structure to target sustainable profitability. Regularly comparing forecasted profits with actual results supports course corrections and better budgeting.

How can forecasting inform a growth strategy for a small business?

In financial forecasting for small businesses, forecasting informs growth strategy by modeling the financial implications of expansion ideas—new products, markets, or headcount—and evaluating them against cash flow and profitability. By running base, optimistic, and pessimistic scenarios, you can prioritize bets that improve returns, ensure funding readiness, and avoid overextending resources.

What are practical steps to build a rolling forecast for financial forecasting for small businesses?

Key steps include: collect historical data and drivers; choose a maintainable forecasting method; define base, optimistic, and pessimistic scenarios; build a monthly rolling forecast; review results and re-forecast; align with budgeting and funding plans; track KPIs like cash flow, margins, and burn rate. This approach keeps financial forecasting for small businesses current and decision-ready.

| Topic | Key Points | Why It Matters |

|---|---|---|

| Introduction | Forecasting is a practical planning discipline that aligns cash flow, costs, and growth with resources; treated as a living tool to guide decisions and profitability. | Guides smarter decisions, improves lender/investor communication, and sets the tone for sustainable profitability. |

| Value of Forecasting | Roadmap for profitability; highlights cash flow needs; informs growth strategy. | Helps allocate resources proactively and reduce surprises. |

| Foundations | Three pillars: revenue, expenses, and timing; revenue realism; fixed vs variable costs; timing of cash flows. | Enables planning for debt service, payroll, and supplier terms. |

| Forecast Horizon & Scenarios | 12–24 months; monthly/quarterly updates; base/optimistic/pessimistic scenarios; scenario planning supports contingency. | Tests resilience and informs decisions under different conditions. |

| Techniques & Tools | Rolling forecast; bottoms-up revenue; separate fixed vs variable costs; cash flow focus; profit planning; growth alignment. | Keeps forecast actionable and aligned with performance. |

| Practical Steps | Gather data; choose method; define scenarios; build monthly forecast; establish cadence; tie to budgeting; monitor KPIs. | Provides a repeatable process driving accuracy and discipline. |

| Pitfalls & How to Avoid Them | Over-optimism, underestimating costs, ignoring seasonality, infrequent updates; use guardrails and clear takeaways. | Prevents biased forecasts that hinder action. |

| Real-World Applications | Seasonal service businesses and inventory-heavy retailers illustrate forecasting benefits. | Demonstrates value in protecting profitability and enabling growth. |

| Implementation Plan | Baseline forecast, add scenarios, rolling updates, align with budget, KPI dashboard, stakeholder communication. | Turns forecast into governance and funding decisions. |

Summary

Financial forecasting for small businesses provides a clear view of how revenue, cash flow, and costs interact, guiding owners toward sustainable profitability. This descriptive process translates assumptions into scenario-based plans, helping allocate resources, time investments, and manage liquidity with confidence. A disciplined approach—employing rolling forecasts, KPI dashboards, and regular stakeholder reviews—enables faster pivots when markets shift. By tying forecasting to budgeting and strategic decisions, small businesses can reduce risk, improve lender and investor communications, and pursue steady growth. In practice, starting small, maintaining consistency, and updating forecasts monthly makes forecasting an actionable engine for resilience and profitability.